ct sales tax exemptions

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making. Cooling centers are open statewide.

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Ad 1 Fill out a simple application.

. Calculating Connecticuts sales and use tax rates. 44 rows Sales and Use Tax Exemption for Purchases Made Under the Buy Connecticut Provision. Connecticut offers an exemption from state sales tax on the purchase.

Manufacturers and industrial processors with facilities located in Connecticut may be eligible for a utility tax exemption. Training and funding provided. Over 300 stakeholders are membersadvisors to the Council including business leaders educators philanthropic and community-based organizations.

There are exceptions to the 635 sales and use tax rate for certain goods and services. Exemption from sales tax for services. Purchases of Meals or Lodging by Tax Exempt Entities.

What is taxed in CT. The state imposes sales and use taxes on retail sales of tangible personal property and services. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

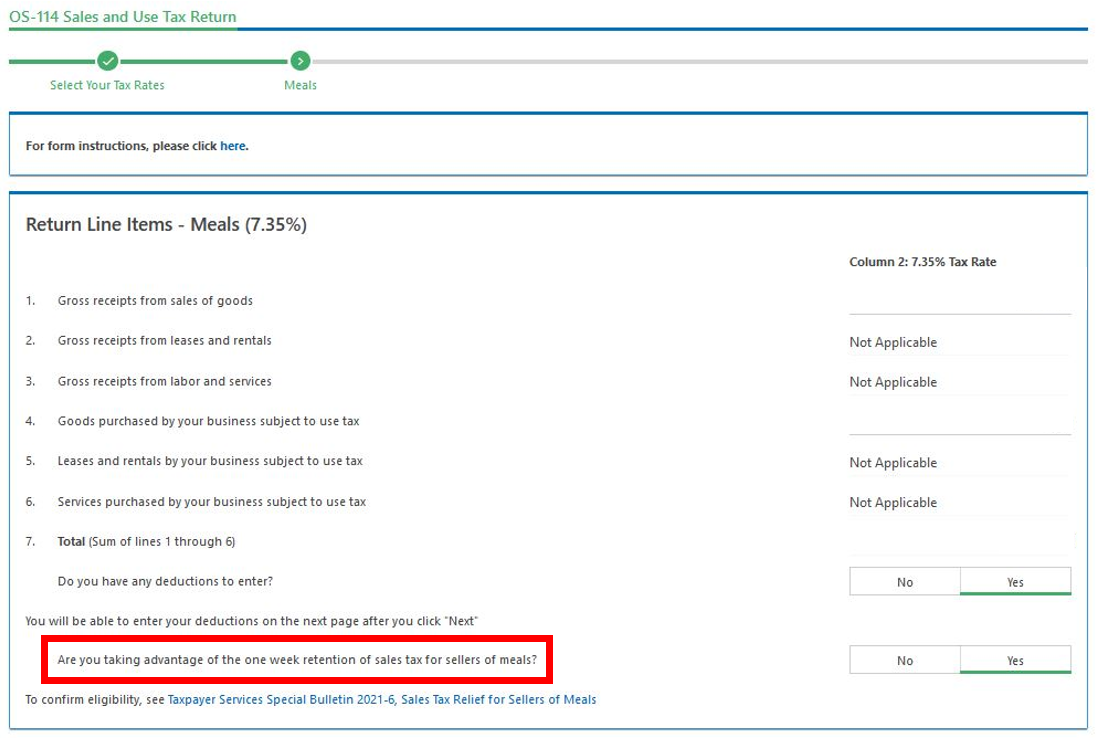

Sales Tax Relief for Sellers of Meals. Municipal governments in Connecticut are also allowed to. 2 Get a resale certificate fast.

Connecticut has a statewide sales tax rate of 635 which has been in place since 1947. Spend less time on tax compliance with an Avalara AvaTax plug in for your shopping cart. Connecticuts Extreme Hot Weather Protocol will be activated from 8AM on Tuesday July 19 through 8PM on Sunday July 24 2022.

Other Sales and Use Tax Forms. Factors determining effective date thereof. Health Care Provider User Fees.

The Connecticut state sales tax rate is 635 and the average CT sales tax after local surtaxes is. Amending a Sales and Use Tax Return. It imposes a 635 tax with some exceptions on the retail sales of tangible personal property.

Exact tax amount may vary for different items. Exemptions from Sales and Use Taxes. Dry Cleaning Establishment Form.

Sales Tax Exempt States information registration support. Municipal governments in Connecticut are also allowed to collect a local-option sales tax that. Ad Complete IRS Tax Forms Online or Print Government Tax Documents.

Sales Tax Relief for Sellers of Meals. Ad 1 Fill out a simple application. 7 on certain luxury motor vehicles boats jewelry clothing and.

Manufacturing and Biotech Sales and Use. 55 on taxable income between. Page 1 of 1.

2022 Connecticut state sales tax. Exemptions from Sales and Use Taxes. Renewal of Your Sales Tax Permit.

To find the nearest. Exemption from sales tax for items purchased with federal food stamp coupons. Are drop shipments subject to sales tax in Connecticut.

Ad New State Sales Tax Registration. 3 on the first 10000 of taxable income. Ad CT ExemptNon-Exempt Status More Fillable Forms Register and Subscribe Now.

Contractors Exempt Purchase Certificate for a Renovation. Amending a Sales and Use Tax Return. Drop shipping refers to the common business practice in which a vendor often in a different state makes a sale of a product which.

Ad Calculate sales tax automatically with an Avalara plugin for the ecommerce system you use. What taxes are paid in CT. Connecticut law provides for an exemption from Connecticut sales and use taxes for qualifying nonprofit organizations.

State tax audits bring transactional errors to the attention of the boss by the state issuing tax assessments. 5 on taxable income between 10001 and 50000. Renewal of Your Sales Tax Permit.

Rental Surcharge Annual Report. The Connecticut Exempt and Taxable sales tax book for manufacturers. Beginning on the July 1st 2011 the state of Connecticut levies a 635 state sales tax on the retail sale lease or rental of most goods.

FilmTVDigital Media Tax Exemptions Find out more about the available tax exemptions on film video and broadcast productions in Connecticut. Sales of Food and Beverages at Schools and Care Facilities Exempt from CT sales tax. How to use sales tax exemption certificates in Connecticut.

Because Connecticut has just one sales tax and no discretionary taxes it is very easy to calculate your tax liability. An organization that was issued a federal Determination Letter of. 2 Get a resale certificate fast.

What is Exempt From Sales Tax In Connecticut. CT Sales Use Taxes. Connecticut has a statewide sales tax rate of 635 which has been in place since 1947.

Sales Tax Relief For Sellers Of Meals

If You Don T Have Nexus And Don T Charge Sales Tax Are You Liable If The Customer Does Not Pay The Tax Sales Tax Institute

Report Ct Never Came Up With A Plan To Collect More Online Sales Tax Connecticut Public

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Only State To Inheritance Tax Estate Tax States

States Sales Taxes On Software Tax Software Software Sales Marketing Software

Connecticut S 2020 Sales Tax Free Week August 16 22

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

Connecticut Manufacturing Sales Tax Exemption For Machinery

Sales Tax Exemption Consumer Healthcare Products Association

Sales Tax On Grocery Items Taxjar

Sales Tax On Business Consulting Services

Exemptions From The Connecticut Sales Tax

What S Exempt From Sales Tax During Connecticut S Sales Tax Free Week Nbc Connecticut